Green & Sustainable Finance: A Path to a Better Future

In today’s rapidly changing world, where climate change and environmental risks pose significant challenges, Green and Sustainable Finance has emerged as a powerful tool to drive the transition to a low-carbon, resilient economy.

Green Finance focuses on financing initiatives aimed at reducing greenhouse gas (GHG) emissions and promoting renewable energy sources. These efforts are crucial in preserving our ecosystems and ensuring a sustainable future for generations to come.

On the other hand, Sustainable Finance goes beyond just environmental concerns. It integrates Environmental, Social, and Governance (ESG) factors into investment decisions, creating long-term value for people, the planet, and businesses alike. By considering social and governance factors alongside environmental goals, sustainable finance drives inclusive economic growth that benefits everyone.

Green and Sustainable Finance are key drivers in achieving global goals like those outlined in the Paris Agreement and the United Nations Sustainable Development Goals (SDGs). These initiatives also support Bangladesh’s own vision for the future, including Vision 2041, the country’s climate action commitments (INDCs), and the Delta Plan 2100 for long-term development. By embracing these goals, we can create a sustainable future not just for Bangladesh, but for the entire planet.

At BRAC Bank, we are committed to supporting this transformation, helping both local and global communities achieve sustainable growth and environmental stewardship. Together, we can build a greener, more sustainable future for all.

Our Approach: Leading the Way in Sustainable Banking

At BRAC Bank, our ambition is to become a leader in sustainable banking, driving impactful change through our business investments and banking practices. We aim to contribute to long-term economic, environmental, and social growth, both locally and globally, by championing green and sustainable finance.

To achieve this, we actively involve our stakeholders in integrating Environmental, Social, and Governance (ESG) factors into every decision we make. This holistic approach ensures that our actions align with the needs of the planet and society, while delivering sustainable value for all.

As part of our commitment, we have set up 50 dedicated Sustainable Finance Help Desks across Bangladesh, ensuring that sustainability issues are addressed quickly and efficiently nationwide. These help desks serve as key touchpoints, offering technical support to clients, such as assessing the value and scope of green projects. Our role is to guide and protect our clients’ interests, making sustainability a central focus of their business.

Additionally, we take proactive steps to manage Environmental and Social Risks for all our clients, following the Environmental and Social Risk Management (ESRM) guidelines guidelines set by both national and international standards. This helps ensure that all our financing decisions support a positive impact on the environment and society.

Currently, 81% of our portfolio is dedicated to sustainable finance, with 24% focused on green finance which makes us a driving force in the market with around 9% share in sustainable finance and around 10% share in green finance, paving the way for a more sustainable future.

Our Sustainable Finance Solutions

At BRAC Bank, we are committed to financing projects that support a sustainable future. Below are the major products we focus on to drive environmental and social impact:

1. Solar & Renewable Energy

Renewable energy is sustainable and inexhaustible, making it an essential solution to climate change. Unlike finite resources like coal or fossil fuels, renewable energy sources like solar power help preserve the environment. With abundant sunlight, we aim to invest more in solar energy and other renewable technologies to build a greener future.

2. Energy-Efficient Technologies

As the world becomes more energy-dependent, adopting energy-efficient technologies has become a necessity for industries to keep up with rising energy costs. These technologies reduce energy consumption, minimize waste, and contribute to climate change mitigation. BRAC Bank is dedicated to financing energy-efficient solutions through various refinancing schemes in collaboration with Bangladesh Bank.

3. Effluent Treatment Plants (ETP) & Water Treatment Plants (WTP)

Effluent Treatment Plants (ETP) treat wastewater to minimize its environmental impact, while Water Treatment Plants (WTP) ensure access to clean, potable water. BRAC Bank is investing in these plants, particularly in areas with water scarcity, such as the coastal regions of Bangladesh, to support public health and environmental sustainability.

4. Green Buildings

A Green Building is designed with eco-friendly materials and energy-efficient systems, certified by LEED, EDGE, GREHA, or SREDA. These buildings minimize resource use, reduce waste, and lower greenhouse gas emissions. We are focused on financing green building projects that align with global sustainability goals, promoting a healthier environment for all.

5. Recycling Plants

In today’s industrial world, waste is a growing concern. By investing in recycling plants, we promote a circular economy, turning waste into valuable resources and reducing the environmental footprint. BRAC Bank supports projects that contribute to waste reduction and a more sustainable future.

6. Environment-Friendly Brick Kilns

Traditional brick kilns contribute significantly to air and water pollution, as well as health issues. To address this, BRAC Bank is investing in modern, cleaner technologies for brick kilns, such as Zigzag Kilns, which reduce pollution and improve worker safety. This supports the government’s push for a cleaner, healthier environment.

7. LED Manufacturing & Assembly

Lighting accounts for a significant portion of electricity use in buildings and industries. LEDs are energy-efficient, cost-effective, and long-lasting. BRAC Bank is focused on financing LED manufacturing and assembly projects to reduce energy consumption and promote sustainable lighting solutions.

8. Lithium Manufacturing Plants

As electric vehicles (EVs) gain popularity, the demand for lithium which is a key component of EV batteries, continues to rise. We are committed to financing lithium manufacturing plants to support the growth of clean, sustainable transportation solutions and reduce reliance on fossil fuels.

9. Waste Management Plants

With Bangladesh’s high population density, waste management is a growing challenge. Waste management plants help convert waste into useful resources, preventing pollution and promoting public health. BRAC Bank is focused on investing in projects that support better waste management practices, contributing to a cleaner and healthier environment.

10. Jute Product Manufacturing

Jute is a biodegradable, sustainable alternative to plastic and other non-degradable materials. As the world moves away from harmful synthetic products, BRAC Bank is investing in jute product manufacturing to promote eco-friendly, organic alternatives, especially in Bangladesh, where jute is a key agricultural product.

Concessional Financing Opportunities

At BRAC Bank, we offer access to various concessional funds and refinancing schemes to support projects and industries that contribute to sustainability and technological development. Below are some key refinancing opportunities available through Bangladesh Bank:

1. Green Refinancing Scheme (GRS)

The Green Refinancing Scheme (GRS) is a revolving refinancing facility of BDT 1000 crore, introduced by Bangladesh Bank to encourage financing for environmentally friendly projects and products.

Key Features:

- Interest Rate: 5%

- Loan Tenure: 3 to 10 years

- Minimum Debt-Equity Ratio: 70:30 on Project

- Major Eligible Projects:

- Renewable Energy

- Energy-Efficient Machinery

- Alternative Energy Solutions

- Liquid & Solid Waste Management

- Recycling & Manufacturing

- Environmentally Friendly Brick Kilns

- Green Agriculture

- Green CMSME (Climate-Smart Micro, Small, and Medium Enterprises)

- Socially Responsible Finance

Click here to read Bangladesh Bank's circular related to GRS

2. Technology Development / Up-gradation Fund (TDF)

The Technology Development Fund (TDF) is a revolving scheme of BDT 1000 crore, introduced by Bangladesh Bank to promote the modernization of export-oriented industries and the development of new technologies.

Key Features:

- Interest Rate: 5%

- Loan Tenure: 3 to 10 years

- Minimum Debt-Equity Ratio: 70:30 on Project

- Major Eligible Products:

- Capital Machinery

- Renewable Energy Products

- Fire Safety Products

- Waste Management Equipment

- Effluent Treatment Plants (ETP) / Water Treatment Plants (WTP)

Click here to read Bangladesh Bank's circular related to TDF

3. Green Transformation Fund (GTF)

The Green Transformation Fund (GTF) is a BDT 5000 crore revolving refinancing scheme designed to drive sustainable growth in export-import oriented industries.

Key Features:

- Interest Rate: 5%

- Loan Tenure: 5 to 10 years

- Minimum Debt-Equity Ratio: 70:30 on Product

- Maximum Loan per Client: BDT 200 crore

- Major Eligible Products:

- Capital Machinery

- Renewable Energy Products

- Fire Safety Products

- Waste Management Equipment

- Effluent Treatment Plants (ETP) / Water Treatment Plants (WTP)

Click here to read Bangladesh Bank's circular related to GTF

Sustainable Finance Help Desk

In line with the regulations set forth by the Central Bank of Bangladesh, BRAC Bank has established 50 dedicated Sustainable Finance Help Desks across the country. These help desks are designed to provide quick and efficient support for customers seeking guidance on green products, sustainable projects, and related financing opportunities. Our team is always ready to assist in understanding the various aspects of sustainable finance, helping you access financial solutions that are environmentally responsible and aligned with global sustainability goals.

Through these help desks, customers can obtain detailed information on available green financing options, eligibility criteria, and the application process for sustainable finance initiatives. Whether you're looking to finance renewable energy projects, energy-efficient technologies, waste management solutions, or other eco-friendly ventures, our dedicated team is here to ensure your journey towards sustainability is smooth and efficient.

Below is the list of BRAC Bank branches that house our Sustainable Finance Help Desks, ready to support your sustainable finance needs:

|

Branch Name |

Branch Name |

Branch Name |

Branch Name |

|---|---|---|---|

|

Satmasjid Road Branch |

Panthapath Branch |

Jatrabari SMESC Branch |

Moghbazar Branch |

|

Uttara Jashim Uddin Branch |

Imamganj Branch |

Mitford Branch |

Shaymoli Branch |

|

JASHORE Branch |

North Gulshan Branch |

Motijheel Branch |

Bonosree Branch |

|

Rajshahi Branch |

Rampura Branch |

Progati Sarani Branch |

Bijoynagar Branch |

|

Dholaikhal Branch |

Mirpur Branch |

Mohammadpur Branch |

Mirpur Section 01 Branch |

|

Natun Bazar Branch |

CDA Avenue Branch |

Agrabad Branch |

KazirDewri Branch |

|

Halishahar Branch |

Ashulia Branch |

Badda Branch |

Banani-11 Branch |

|

Barisal Branch |

Board Bazar Branch |

Bogura Branch |

Chuadanga Branch |

|

Cumilla Branch |

Demra Branch |

Faridpur Branch |

Islampur Branch |

|

Khulna Branch |

Madhabdi Branch |

Maijdee Branch |

Mohakhali Branch |

|

Moulvibazar Branch |

Mymensingh Branch |

Narayanganj Branch |

Pabna Branch |

|

Rangpur Branch |

Savar Branch |

Sirajganj Branch |

Sylhet Branch |

|

Tangail Branch |

Zinzira Branch |

Key Features of Sustainable Finance Help Desks:

- Expert Assistance: Our knowledgeable staff at each help desk provides tailored advice on sustainable finance options that suit your business or personal project.

- Guidance on Green Products: Get clear information on available green products, including renewable energy solutions, waste management systems, and eco-friendly technologies.

- Application Support: Assistance with the application process for financing sustainable projects, ensuring compliance with all relevant regulations and eligibility criteria.

- ESG Considerations: Learn how integrating Environmental, Social, and Governance (ESG) factors into your decision-making can help you achieve long-term sustainability goals.

Visit a Sustainable Finance Help Desk Near You:

If you're interested in exploring sustainable finance solutions or need guidance on financing a green project, visit one of our 50 dedicated Sustainable Finance Help Desks across the country. Our experts are ready to help you navigate through the various financing options available and support you on your path to a more sustainable future.

Feel free to contact us or visit any of the listed branches to get started on your sustainability journey today.

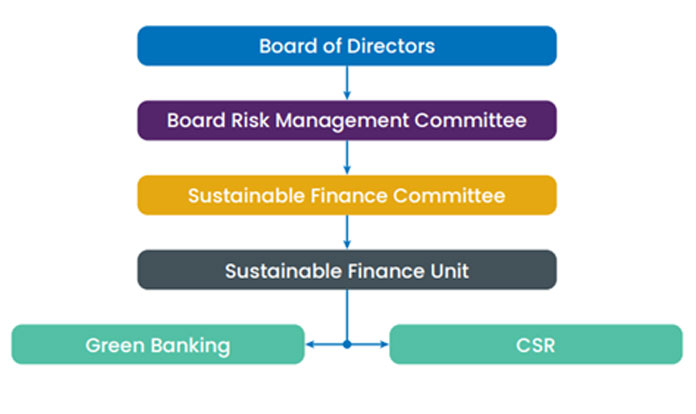

Organogram & Sustainable Finance Committee (SFC)

BRAC Bank has established two core wings under its Sustainable Finance Unit: Green Banking and Corporate Social Responsibility (CSR). These wings work collaboratively to integrate sustainable finance initiatives across the bank's operations. The Sustainable Finance Unit is overseen by the Sustainable Finance Committee (SFC), which is responsible for ensuring effective implementation and management of the bank's sustainable finance strategies. The SFC directly reports to the Board Risk Management Committee, ensuring transparency and alignment with the bank’s overall risk management framework.

Sustainable Finance Committee (SFC)

The Sustainable Finance Committee (SFC) plays a critical role in ensuring the smooth operation and continuous improvement of sustainable finance practices at BRAC Bank. The committee is responsible for overseeing the development and execution of sustainable finance projects, ensuring alignment with national and international standards, and driving the bank's commitment to sustainability.

Below is the list of members of the Sustainable Finance Committee:

|

No. |

Name |

Designation |

Place within the committee |

|---|---|---|---|

|

1 |

Md. Sabbir Hossain |

DMD & Chief Operating Officer |

Chairman |

|

2 |

Mohammod Masud Rana FCA |

DMD & CFO |

Member |

|

3 |

Tareq Refat Ullah Khan |

DMD & Head of Corporate Banking |

Member |

|

4 |

Syed Abdul Momen |

DMD & Head of SME Banking |

Member |

|

5 |

Md. Shaheen Iqbal, CFA |

DMD & Head of Treasury & FI |

Member |

|

6 |

Md. Mahiul Islam |

DMD & Head of Retail Banking |

Member |

|

7 |

Ahmed Rashid Joy |

DMD & Chief Risk Officer |

Member |

|

8 |

Sheikh Mohammad Ashfaque |

DMD & Head of Branches |

Member |

|

9 |

M. Sarwar Ahmed |

Head of ICC |

Member |

|

10 |

Md. Muniruzzaman Molla |

Head of Operations |

Member |

|

11 |

Akhteruddin Mahmood |

Head of HR |

Member |

|

12 |

Nurun Nahar Begum |

Chief Technology Officer |

Member |

|

13 |

Brig Gen Md. Amin Akbar (Rtd) |

Head of General Services |

Member |

|

14 |

Ekram Kabir |

Head of Communication |

Member |

|

15 |

Indraneel Chattopadhyay |

Chief Marketing Officer |

Member |

|

16 |

Tashmeem Muntazir Chowdhury |

Head of Sustainable |

Member Secretary |

Training and Capacity Building

At BRAC Bank, we prioritize continuous training to promote sustainability across our organization. We regularly organize internal and external training sessions to enhance our employees' knowledge on sustainable finance, green banking practices, and ESG factors.

Key Initiatives:

- Employee Training: Regular internal sessions to build understanding of sustainable finance principles.

- Relationship Manager Training: Specialized programs to equip managers with expertise in green financing and sustainability.

- External Knowledge Sharing: Participation in external workshops and industry programs to stay updated on global trends.

- Capacity Building: Ongoing development to ensure all employees are aligned with our sustainability goals.

By focusing on education and capacity building, we empower our employees to drive sustainability and support our green initiatives effectively.

Sustainable Finance

Unit is Delivering Training to Branch Managers

Sustainable Finance

Unit is Delivering Training to Branch Managers

Sustainable Finance

Unit is Delivering Training of Sustainable Finance Helpdesk to

Branch Employees

Sustainable Finance

Unit is Delivering Training of Sustainable Finance Helpdesk to

Branch Employees

Sustainable Finance

Unit is Delivering Training to Corporate Relationship

Managers

Sustainable Finance

Unit is Delivering Training to Corporate Relationship

Managers

Sustainable

External Training on Solar & Renewable Energy to Relationship &

Credit Managers

Sustainable

External Training on Solar & Renewable Energy to Relationship &

Credit Managers

Training on circular economy

partnered with European Investment Bank (EIB)

Training on circular economy

partnered with European Investment Bank (EIB) and the Frankfurt School of Finance and Management

Sustainability Report

Since 2022, BRAC Bank has been publishing its annual Sustainability Report, adhering to global standards such as PCAF, GRI, and IFRS. This approach ensures transparency, accountability, and measurable outcomes in our sustainability initiatives. The report highlights our commitment to sustainable finance, focusing on financing projects that promote environmental sustainability and deliver long-term value for our stakeholders.

Key priorities outlined in the report include our proactive efforts in climate risk management and the development of green banking solutions aimed at mitigating the effects of climate change. The report also emphasizes our dedication to financial inclusion, particularly through empowering small businesses, women entrepreneurs, and underserved communities, enabling them to access financial services that contribute to sustainable economic growth.

Furthermore, the report details our progress in disclosing greenhouse gas emissions, in line with international sustainability frameworks, and our continued focus on digital transformation, governance improvements, and corporate social responsibility. These efforts are designed to ensure a positive, lasting impact on both the environment and society.

You can access all the reports here.

PCAF Commitment

As a signatory of the Partnership for Carbon Accounting Financials (PCAF), BRAC Bank is committed to calculating and disclosing its greenhouse gas (GHG) emissions across Scope 1, Scope 2, and Scope 3, using the PCAF methodology. This commitment aligns with our broader sustainability goals and emphasizes transparency in our operations. Our GHG emission data, fully endorsed by PCAF, is publicly available on their website, providing full visibility into our progress and ensuring that our practices align with international reporting standards.

You can view our sustainability data on PCAF's website through this link.

Through the PCAF framework, we are able to set science-based targets for reducing our carbon footprint, ensuring that our portfolio aligns with the Paris Climate Agreement. As a member of the Global Alliance for Banking on Values (GABV), BRAC Bank strives to demonstrate responsible, sustainable, and inclusive practices within the financial sector. By openly reporting and continuously improving our sustainability performance, we aim to set a leading example for others in the industry to follow.

Contact - Sustainable Finance

Tashmeem Muntazir Chowdhury

Head of Sustainable Finance

Email: [email protected]

Tasfin Fahad

Associate Manager, Sustainable Finance

Email: [email protected]

Mohimenul Hasan

Associate Manager, Sustainable Finance

Email:

[email protected]

Feedback / Grievance

Accolades

We are proud and honored to share

that we have received the title of one of the top sustainable

We are proud and honored to share

that we have received the title of one of the top sustainable banks in the country for Four consecutive years (2020, 2021, 2022 and 2023) from the central bank.

Bloomberg has ranked BRAC Bank as

one of the top sustainable companies in Bangladesh for

Bloomberg has ranked BRAC Bank as

one of the top sustainable companies in Bangladesh for 2024, awarding it a score of 43.37, surpassing several major companies in the country.

Mr. Sabbir Hossain, DMD and

COO of BRAC Bank PLC. awarded as

Mr. Sabbir Hossain, DMD and

COO of BRAC Bank PLC. awarded as UNGCNB SDG Pioneer 2024 form Bangladesh

BRAC Bank’s Head of Sustainable

Finance at the fully funded leadership development program

BRAC Bank’s Head of Sustainable

Finance at the fully funded leadership development program on sustainability by IFC in Geneva, Switzerland

Mon, Oct 6, 2025 11:28 AM

| Currency | Buying | Selling |

|---|---|---|

| USD | 121.5000 | 122.5000 |

| EUR | 141.5743 | 144.1829 |

| GBP | 162.4318 | 165.4285 |